So much for a blockbuster NFP.

98k, negative revisions and a miss in hours set us up for an interesting April. Combined with some weakness in the other data points from last week, and I think we’re set up for an interesting Q1 GDP read. I surely like the #lower4longer play here, notwithstanding Friday afternoon’s sell off. As I mentioned Thursday, the range is likely to remain intact through the NFP, and despite a really good attempt to break through on a terrible number, we closed above 2.30, 2.38 in fact. The approach here should be to continue to lock/float the range, with perhaps a bit less caution.

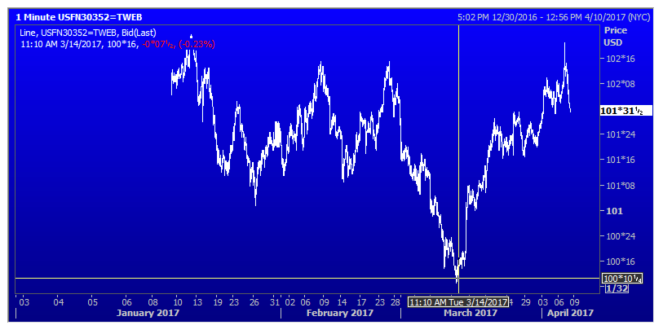

If we chart this year’s March bounce (see below), you’ll notice we got back just a bit over the 200 I suggested was there, if just for a moment early Friday morning. We’ve obviously faded since. I can’t stress enough that up around that high in price there are some significant technical implications, so I wouldn’t read too much into finishing in the red other than 2.0 just wasn’t meant to be on Friday. At the moment we’re set to open flatfish, so while I’m disappointed we’re not poised to rally, we also aren’t auto-tanking. So we got that going for us, which is nice (congrats Sergio). It is a fairly slow week for data, but we begin to heat up at the end of the week.

PS I want thank my fellow Primer’s for supporting the Pediatric Cancer cause I posted Thursday. As I mentioned, my son had already hit his goal by donating his own money, but our efforts pushed the entire team beyond their goal! While there have been some tremendously generous contributions, even just $1 could change the lives of those battling this horrible disease. Please join our fight and please share the link with others so we can really make a difference! Here’s the link for those who missed it.

https://donate.go4thegoal.org/fundraiser/947640

-Philip Mancuso